Thinking Of Starting A Business?

Finance Before Fun

Starting a business can be exhilarating but also exhausting.

The start-up phase has a number of moving parts and you need to work your way through various rules and regulations. While the right business structure is important, you also need the right accounting software program, adequate and appropriate insurances plus a brand that appeals to your target market. You also need to dot the i's and cross the t's on your contracts and property lease. Don't forget your marketing plan including your website and social media channels.

There's a lot to cover!

Enthusiastic entrepreneurs are usually in a hurry to convert their idea into income, but they can sometimes put the cart before the horse. Before you pull the trigger on your business idea you need to make sure the business is financially viable. If it doesn't pass the financial test, then all the other things don't matter. For that reason, your cash flow budget and business plan should be high on your list of priorities.

CASH IS KING

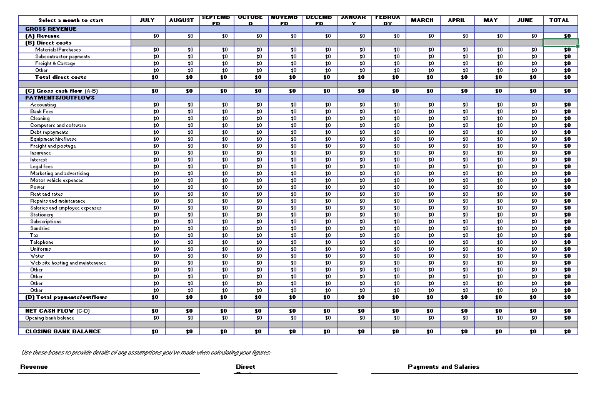

In business, failing to plan is planning to fail so you need to prepare a cash flow budget for your first year of trading. Consider preparing figures based on your best and worst-case sales scenarios. It's not easy to project your revenue when you haven't opened your doors, but you can't afford to wait for more certainty regarding your sales projections and costs. Remember, a positive cash flow is a necessity if your business is to succeed and positive cash flow just doesn't happen, it needs to be planned.

Any new business owner that fails to accurately forecast their cash flow for the first 12 months could find themselves on a collision

course. Without realistic cash flow projections, management cannot identify future cash shortages and a bank won't look favourably on a

request for additional funding in the early stages of operation. When preparing your cash flow budget, you need to make a number of

assumptions regarding the financial performance of the business and these assumptions must be supported by research, available data plus

known facts such as rent and forward contracts.

Any new business owner that fails to accurately forecast their cash flow for the first 12 months could find themselves on a collision

course. Without realistic cash flow projections, management cannot identify future cash shortages and a bank won't look favourably on a

request for additional funding in the early stages of operation. When preparing your cash flow budget, you need to make a number of

assumptions regarding the financial performance of the business and these assumptions must be supported by research, available data plus

known facts such as rent and forward contracts.

The information in your cash flow budget is designed to:

- forecast your likely cash position at the end of each month

- identify any fluctuations that may lead to potential cash shortages

- plan for your taxation payments

- plan for any major capital expenditure, and

- provide prospective lenders with key financial information

Of course, positive cash flow alone is not enough. The business must be returning a profit and the long-term trend for both must be

positive. All too often we hear of profitable businesses that collapse due to insufficient cash flow. As accountants, we can do some

financial modelling for you and produce cash flows based on different price points and scenarios.

Preparing a cash flow forecast starts with projecting your sales. You’ll need to make assumptions on pricing plus you’ll need to factor in things like the seasonality of your business and the state of the economy. From a cash flow point of view, you need to think about how quickly you'll get paid after invoicing your customers. Ask yourself, if you expect to be paid in 30 days, what would happen to your cash flow if that blew out to 90 days? Would you need to borrow more from the bank at that point? Extending your overdraft or sourcing extra loans after a few months of trading would set off alarm bells at the bank.

Once you are comfortable with the revenue projections it's time to focus on the costs. You need to dissect your start-up costs into categories like the office or shop fit out, equipment, IT expenses, professional fees, marketing costs, website production and furniture. You then need to look at your fixed costs like monthly rent, insurances, rates and internet. Finally, look at the costs that vary based on your sales including wages and material inputs. Cash flow projections can be a jigsaw to put together, but you are the most qualified person to make all the sales and pricing assumptions. You've researched the market in your industry, know your competitor's prices and have developed your points of difference.

BUSINESS PLAN

The main reason most entrepreneurs produce a business plan is to raise finance from a bank. As you would expect, a lender will want to know all about you and your proposed venture and the business plan provides all this information in a logical and structured format. It allows potential investors to evaluate your pitch and make an informed investment decision. However, your business plan should do more than just satisfy your investors. It should prove the financial viability of your business and provide an overview of where you plan to take the business and how you intend to get there. It can be expressed as a series of objectives and then detail the strategies, tools and people who are going to make it happen.

If you are contemplating starting a business, the planning phase can be a period of great anxiety due to a combination of excitement, uncertainty and financial risk. Over the years we have mentored hundreds of business owners through the start-up phase and built a reputation as business start-up specialists. Along the way we have put together a range of tools, templates and checklists to help you get your business off to a flying start.

For example, you can download a free copy of our New Business Starter Kit from our website that contains dedicated chapters on business structures, registrations, insurances, software, marketing, cash flow and legal matters. It also has a valuable 82-point checklist to guide you through the start-up process. Finally, you don't need to reinvent the wheel because the resources section of our website gives you access to a range of tools including a business plan and cash flow budget template. If you're thinking of starting a business, contact us today.

This article forms part of our September 2018 Business Accelerator Magazine. Click HERE to download the full edition or browse other articles in this edition below:

Other Articles in this Edition:

- Franchisee Gets Massive Fine for Poor Record Keeping

- Beware Just Claiming 'Standard Deductions' This Financial Year

- What's on the ATO Hitlist this Year?

- Death and Taxes

- Law Changes Impacting Business Owners

-

Expand Your Customer Base

with Facebook Advertising

IMPORTANT DISCLAIMER: This article contains general advice only and is prepared without taking into account your particular objectives, financial circumstances and needs. The information provided is not a substitute for legal, tax and financial product advice. Before making any decision based on this information, you should speak to a licensed financial advisor who should assess its relevance to your individual circumstances. While the firm believes the information is accurate, no warranty is given as to its accuracy and persons who rely on this information do so at their own risk. The information provided in this article is not considered financial product advice for the purposes of the Corporations Act 2001.