Personal Taxation 2014

New Temporary Budget Repair Levy

Approximately 400,000 individuals with incomes over $180,000 will be subject to the Temporary Budget Repair Levy. A 2% levy on taxable income exceeding $180,000 will take effect from 1 July 2014 for three years. In conjunction with the 2% FBT rate increase from 1 April 2015, this announcement is expected to reignite interest in tax planning opportunities.

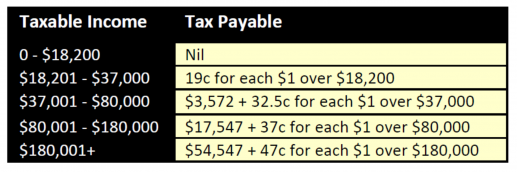

Income Tax

Including the Temporary Budget Repair Levy (assuming legislation receives assent) the personal income tax rates for the 2014/15 year (excluding the Medicare Levy) will be as per the table.

Medicare Levy

The Medicare Levy will increase from 1.5% to 2% from 1st July 2014 (to fund the Disability Care Australia scheme) therefore individuals whose taxable income is in excess of $180,000 will effectively pay 49% tax on income earnt over that amount. For the 2013/14 year, the Medicare levy low-income threshold for families has been indexed up from the 2012/13 amount of $33,693 to $34,367. The additional amount of threshold for each dependent child or student will be increased to $3,156.

Family Tax Benefit & Other Welfare Reforms

Eligibility thresholds for non-pension payments will be frozen for 3 years from 1st July 2014. This will include payments such as Family Tax Benefit, Child Care Benefit, Child Care Rebate, Newstart Allowance, Parenting Payments and Youth Allowance. A range of reforms to Family Tax Benefits have been proposed which will primarily limit the availability of these benefits.

- The Family Tax Benefit B (FTBB) primary earner income limit will be reduced from $150,000 to $100,000 per annum as of 1st July 2015. As such, around 10% of the 1.4 million families who currently receive FTBB will no longer receive the payment.

- Access to FTBB will be restricted to families where the youngest child is less than 6 years of age as at 1st July 2015. Transitionally, those whose youngest child is aged 6 and over on 30th June 2015 will continue to be eligible for 2 years. Under the current system, families could claim the benefit until the oldest child turned 18 provided they were still in education.

- The income threshold for the Dependent (Invalid and Carer) Tax Offset (DICTO) will also be reduced to $100,000 from 1 July 2015.

- The income thresholds of Family Tax Benefit Part A will no longer be linked to inflation and rates will be frozen until June 30, 2017.

- The payment rate for Family Tax Benefit A (FTBA) and Family Tax Benefit B (FTBB) will be frozen from 1st July 2014 to 30th June 2016.

- From 1 July 2015, a per-child add-on amount will no longer be used to calculate a family’s higher income-free area for FTBA. The higher income-free area of $94,316 will remain, without the add-on amount of $3,796 for the second child and subsequent children.

- As of 1st July 2015 FTBA & FTBB end of year supplements have returned to their original rates (of $600 and $300 respectively) and will remain at that rate instead of being index linked.

- The FTBA Large Family Supplement (currently $12.04 per child per fortnight payable on the third child and each child after that) has been changed and only applies to families with four or more children as of 1st July 2015.

- A new allowance of $750 per child aged between six and 12 years will be introduced for single parents on the maximum rate of FTB Part A whose youngest child is between six and 12 years of age at which point they become ineligible for the FTB Part B. This allowance will commence from 1 July 2015.

Medical Co-Payments

Costs for visits to the doctor (and out of hospital pathology and diagnostic imaging providers) will increase from 1st July 2015 when a co-payment of $7 will apply. Concession card holders or children under 16 years will pay the $7 for the first 10 visits per year. Prescription medicines will also cost more from 1st January 2015 with general payments increasing $5 from $37.70 to $42.70 and concession payments increasing eighty cents from $6.10 to $6.90.

Unemployment Benefits

Under the government’s ‘Earn or Learn’ initiative, access to unemployment benefits for under 30s will only be available from 1st January 2015 after serving a six month waiting period and demonstrating job search and participation in employment services support. Then after six months, claimants will be required to participate in Work for the Dole to receive income support.

Reduced Tax Offsets

Most dependant tax offsets have been abolished including the Mature Worker Tax Offset and Dependent Spouse Tax Offset (DSTO). The DSTO is replaced by Dependent (Invalid and Carer) Tax Offset (DICTO) for taxpayers with a dependant who is genuinely unable to work due to a carer obligation or a disability. Additionally, the income threshold for Dependent (Invalid and Carer) Tax Offset will be reduced to $100,000 per annum

Education

HELP Debt Repayments

Graduates will repay tertiary education loans at a lower income threshold of $50,638 from 2016 (a 10% reduction) and the interest rate on loans will be changed to reflect the cost of borrowing (to a maximum of 6%).

Apprenticeships

The ‘Tools for Your Trade’ program will cease from 1st July 2014 and be replaced by Trade Support Loans which offer HECS style loans of up to $20,000 to apprentices in occupations on the National Skills Needs List. A 20% discount applies to apprentices who complete their apprenticeships.

Non-Residents

For the 2014/15 year, a flat rate of tax of 32.5 per cent will apply to all taxable income of non-residents up to $80,000. For taxable income exceeding $80,000, the marginal tax rates for non-residents are the same as those for resident individuals noted above. Non-residents are also expected to bear the burden of the Temporary Budget Repair Levy.

Click HERE to download the full edition of The Business Accelerator Magazine for June 2014.

Other articles in this edition:

- 2014 Individual Tax Return Checklist

- 2014 Companies, Partnerships, Trusts & Other Business Tax Checklist

- 2014 Budget Overview

- Budget Changes For Business

- Superannuation & Retirement Changes

- Business Start Up Corner - Thinking Of Starting A Business?

- ATO & Superannuation

- Where There's A Will...

- Claiming Travel Between Home & Work

- What's A Business Worth?

- Why Your Business Needs To Be Google Friendly

- Mobile Money

- Reading Corner - The E-Myth Revisted

- One Stop Shops For Social Media

- Tech Corner - Parking Maestro

- A Minute On Marketing - 7 Killer Marketing Words